The market moves fast, often feeling like a blur of tickers, news flashes, and talking heads. For any serious investor, from the absolute beginner to the seasoned pro, trying to keep up without a system is a recipe for overwhelm—and missed opportunities. That's where a well-chosen watchlist app or platform becomes your indispensable co-pilot, helping you cut through the noise and focus on what truly matters to your financial future.

It's not just about tracking prices; it's about understanding the pulse of companies you own, or are considering owning. It's about spotting trends, reacting to critical news, and keeping your investment strategy sharp and informed. But with a crowded field of tools, how do you pick the right one? Let's dive into Choosing Watchlist Apps & Platforms that truly empower your investing journey.

At a Glance: Your Watchlist App Checklist

Before we explore specific platforms, here are the key takeaways to guide your choice:

- Align with Your Strategy: Your app should match your investing style (e.g., active trading, long-term value, technical analysis).

- Prioritize Smart Alerts: Look for notifications that explain why something is happening, not just that it happened.

- Demand Data Depth: Quick access to fundamental metrics and, ideally, SEC filing summaries is crucial.

- Embrace Organization: Multiple watchlists are essential for categorizing potential investments.

- Cross-Platform Sync is Non-Negotiable: Access your data seamlessly from any device.

- Don't Overlook Free Options: Many robust tools exist without a price tag, especially for beginners.

- Consider Your Broker: Your existing brokerage might have basic tools, but dedicated apps often offer more power.

Why a Watchlist Isn't Just a "Nice-to-Have"—It's Essential

Think of your investment watchlist as your personal reconnaissance dashboard. It’s a dynamic, customizable list of companies, cryptocurrencies, indices, or other assets you want to monitor closely. While the core function is to track price movements and performance, the best watchlist tools go far beyond mere numbers. They help you understand the underlying business activities, competitive landscape, and market sentiment, allowing you to:

- Spot Opportunities: Identify potential entry or exit points for new investments or existing holdings.

- Stay Informed: Keep tabs on critical news, earnings reports, and regulatory filings that could impact your positions.

- Track Performance: Monitor how potential investments are performing over time without committing capital.

- Organize Your Ideas: Categorize stocks by sector, investment thesis, or stage of research.

- Refine Your Strategy: Learn from past picks, observe market reactions, and adapt your approach.

In essence, a watchlist transforms market chaos into a manageable, actionable feed, allowing you to react thoughtfully rather than impulsively.

The Non-Negotiable Features Your Watchlist App Needs

Not all watchlist apps are created equal. To genuinely empower your investing, your chosen platform needs a robust set of features. Don't settle for less than these essentials:

Intelligent Alerts: Beyond "Price Hit X"

Basic price alerts are a starting point, but they're often not enough. A truly valuable watchlist app provides intelligent alerts that explain why something matters. Did a stock hit its 52-week high? Did institutional ownership shift? Was there a major news announcement? Look for apps that offer:

- Contextual Notifications: Alerts tied to specific news events, regulatory filings, or significant percentage moves.

- Customizable Triggers: The ability to set alerts based on various conditions, such as technical indicators, volume spikes, or fundamental data changes.

- Multi-Channel Delivery: Desktop pop-ups, email, SMS, or even audio squawks to ensure you don't miss critical developments.

SEC Filing Summaries & Access: Unpacking the "Why"

For any serious investor, understanding a company means digging into its official reports. While reading full 10-K and 10-Q filings can be daunting, your watchlist app should at least:

- Surface New Filings: Immediately inform you when a company on your list publishes a new regulatory document.

- Provide Direct Links: Easy access to the full filings for those deep dives.

- Offer Summaries or Key Point Extraction: This is where cutting-edge apps shine. Tools that use AI to summarize complex legal documents or highlight critical changes can save you hours of research. This allows you to grasp the core message quickly, helping you determine if a full read-through is necessary.

Integrated News Feeds: Filtering Noise, Finding Signals

News moves markets, but the sheer volume of information can be overwhelming. Your watchlist app should offer:

- Relevant News Aggregation: Pulling in articles and reports specifically for the companies on your list.

- Filtering and Categorization: The ability to sort news by source, topic, or sentiment to focus on what matters most to your strategy.

- Real-time Updates: For active traders, immediate access to breaking news is paramount. For long-term investors, a daily digest might suffice.

Fundamental Data at Your Fingertips: Quick Reference, Deep Understanding

While charts show price action, fundamental data reveals the health of the underlying business. Your app should provide quick access to key metrics like:

- Market Capitalization: The total value of a company's outstanding shares.

- P/E Ratio (Price-to-Earnings): A common valuation metric.

- Revenue and Earnings Growth: Indicators of a company's financial performance.

- Dividend Yield: Crucial for income investors.

- Debt-to-Equity: A measure of financial leverage.

The more historical data and comparative metrics an app offers, the richer your analysis can be.

Multiple Watchlists for Organization: Tame the Chaos

A single, sprawling watchlist quickly becomes unwieldy. The best platforms allow you to create multiple, specialized watchlists for different purposes:

- By Sector: Group tech stocks, healthcare companies, energy plays, etc.

- By Strategy: "Potential Buys," "Dividend Stocks," "Growth Stocks," "Undervalued Targets."

- By Status: "Researching," "On Hold," "Monitoring Existing Holdings."

- By Asset Class: Separate lists for stocks, crypto, forex, commodities.

This organizational power ensures clarity and focus, preventing analysis paralysis.

Seamless Cross-Platform Sync: Consistency Across Devices

Whether you're checking your phone on the go, analyzing charts on your tablet, or doing deep research on your desktop, your watchlist data needs to be consistent. Look for apps that offer:

- Web-based Platform: Accessible from any browser.

- Dedicated Mobile Apps: For iOS and Android, offering full functionality.

- Real-time Synchronization: Changes made on one device instantly update on all others.

This ensures you always have the most current information and the ability to act, no matter where you are.

Excellent Free Watchlist Apps & Platforms: Get Started Without Opening Your Wallet

You don't always need to pay a premium to get a valuable watchlist tool. Many platforms offer robust free tiers that are perfect for beginners or those with simpler needs.

Yahoo Finance: The Everyday Investor's Friend

- Best For: Everyday investors, beginners, casual market observers, basic tracking of stocks and cryptos.

- Highlights: Yahoo Finance is a household name for a reason. Its free offering provides a straightforward, user-friendly experience for creating and managing multiple watchlists across various asset classes. You get real-time quotes, fundamental data, basic charting, and integrated news. It's an excellent starting point for familiarizing yourself with market dynamics.

- Key Features:

- Easy-to-create watchlists for stocks, indices, cryptocurrencies.

- Real-time quotes and basic charting tools.

- Integrated news feed and fundamental data points.

- Cross-platform syncing across web and mobile.

- Basic price alerts.

- Pricing: Free for core features. Paid plans range from $7.95 to $39.95 per month for more advanced data, ad-free experience, and additional analytics.

- Pros: Very intuitive, widely used, good for general market awareness, syncs well.

- Cons: Limited in advanced analytical tools, charting is basic, news can be noisy.

AssetRoom: Beyond the Ticker, Into the Business

- Best For: Investors who want to understand what companies are doing rather than just stock prices, long-term fundamental investors, those seeking unique insights.

- Highlights: AssetRoom takes a distinct approach by focusing heavily on public company disclosures. It uses AI to summarize complex SEC filings (10-K, 10-Q), emailing you key points and highlighting changes. This is invaluable for understanding the operational side of a business. It also fosters community engagement through weekly polls on bull and bear cases for new stocks.

- Key Features:

- AI-powered summaries of SEC filings delivered to your inbox.

- Focus on business activities and underlying changes, not just price.

- Community polls to discover new stock ideas with bull/bear arguments.

- Customizable watchlists.

- Pricing: Completely free.

- Pros: Uniquely focuses on fundamental business changes, AI summaries are a massive time-saver, excellent for due diligence, discover new stocks through community.

- Cons: Less focused on real-time price action or advanced technical analysis, may not appeal to active traders.

TradingView (with limitations): Charting Power, With a Catch

- Best For: Beginners interested in technical analysis, multi-asset tracking (stocks, crypto, forex), visual learners.

- Highlights: TradingView is renowned for its exceptional charting capabilities. Even its free plan offers a robust platform for basic charting and creating multi-asset watchlists. It's a great way to dip your toes into technical analysis without commitment, though you'll encounter limitations.

- Key Features:

- Advanced charting system with various chart types and drawing tools.

- Multi-asset watchlists (stocks, crypto, forex).

- Excellent cross-platform syncing.

- Community features for sharing ideas.

- Pricing: Free plan with ads, limited indicators (3 per chart), and potentially delayed data for some markets. Paid plans range from $13.99 to $199.95 per month for more indicators, ad-free experience, real-time data, and advanced features.

- Pros: Industry-leading charting, vast array of assets, strong community, good sync.

- Cons: Free plan is ad-supported, limits on indicators and chart layouts, delayed data for some exchanges can be a hindrance for active monitoring.

Koyfin (with limitations): A Glimpse into Pro Data

- Best For: Beginners wanting exposure to institutional-quality data, fundamental investors, those interested in macroeconomic insights.

- Highlights: Koyfin brings institutional-grade financial data to the everyday investor, even in its free tier. You can create two watchlists and two screens, allowing you to get a taste of its powerful data visualization and customization options. It's an excellent way to see what professional-grade tools can offer before committing financially.

- Key Features:

- Free beginner package with two watchlists and two screens.

- Customizable dashboards with advanced charts.

- Real-time news feeds integrated with watchlists.

- Access to fundamental, technical, and macroeconomic data points.

- Pricing: Free plan has limitations. Paid plans offering unlimited features start at $39 per month, scaling up to $299 per month for advanced professional use.

- Pros: Access to institutional-quality data, highly customizable interface, good for fundamental and macro analysis.

- Cons: Free plan is very limited in the number of watchlists and screens, steep pricing jump to paid tiers.

Premium Watchlist Apps & Platforms Worth the Investment

For investors who demand more depth, speed, or specialized tools, a paid subscription can be a significant investment that pays dividends. These platforms often provide real-time data, advanced analytics, and a more tailored experience.

Benzinga Pro: The Active Trader's Real-Time Nerve Center

- Best For: Active traders, day traders, investors who prioritize real-time news and market-moving catalysts.

- Highlights: Benzinga Pro is built for speed and real-time information. It integrates customizable watchlists directly with a lightning-fast news feed, providing instant alerts for breaking news, price changes, and market catalysts. If you need to react quickly to market events, this is your platform.

- Key Features:

- Real-time data for U.S. stocks.

- Customizable watchlists linked to real-time news feed.

- Instant alerts via desktop, email, sound, and the unique Audio Squawk for breaking news.

- Cross-platform syncing.

- Pricing: Basic ($37/month), Streamlined ($147/month), Essential ($197/month). Discounts often available for annual subscriptions.

- Pros: Unparalleled real-time news flow, excellent for active traders, powerful alert system, Audio Squawk is unique.

- Cons: Less comprehensive charting compared to dedicated charting platforms, potentially high cost for individual traders, focus is heavily on news reaction rather than deep fundamental research.

TradingView (Paid Tiers): Master Your Charts, Master Your Trades

- Best For: Technical analysts, multi-asset traders (stocks, crypto, forex), chart-focused investors who need extensive indicators and drawing tools.

- Highlights: Stepping up to a paid TradingView plan unlocks its full potential. You get an ad-free experience, real-time data for most markets, unlimited indicators per chart, advanced chart types, and comprehensive drawing tools. The ability to create alerts based on complex Pine Script conditions makes it incredibly powerful for automated monitoring.

- Key Features:

- Industry-leading advanced charting with diverse chart types and over 100 technical indicators.

- Multiple custom watchlists for stocks, cryptocurrencies, and forex.

- Excellent cross-platform syncing.

- Advanced alerts based on price levels, indicators, or custom Pine Script conditions.

- Paper trading and backtesting capabilities.

- Pricing: Pro ($13.99/month), Pro+ ($24.95/month), Premium ($49.95/month), and higher tiers for professionals ($199.95/month). Discounts for annual billing.

- Pros: Best-in-class charting and technical analysis tools, highly customizable, powerful alert engine, vast community for idea sharing.

- Cons: Can have a steep learning curve for beginners due to the depth of features, premium features come at a premium price.

Stock Rover: Deep Dives for the Long-Term Investor

- Best For: Long-term investors, professional investors, value investors, dividend investors, those focused on in-depth fundamental analysis.

- Highlights: Stock Rover is a powerhouse for fundamental analysis and portfolio management. It allows you to create highly customizable watchlists linked to your brokerage accounts, offering extensive columns for fundamental, operational, and financial metrics. With up to 10 years of historical data, powerful screening tools, and dividend income projections, it's designed for serious research.

- Key Features:

- Customizable watchlists with hundreds of columns for fundamental, operational, and financial metrics.

- Up to 10 years of historical financial data for detailed analysis.

- Powerful screening tools to find stocks matching specific criteria.

- Portfolio analytics and dividend income projections.

- Integration with brokerage accounts for holistic portfolio tracking.

- Pricing: Essentials ($7.99/month), Premium ($17.99/month), Premium Plus ($27.99/month), with significant discounts for longer subscriptions.

- Pros: Extremely deep fundamental data, powerful screening and comparison tools, excellent for long-term and value investing, strong portfolio analytics.

- Cons: Interface can be complex and overwhelming for beginners, primarily focuses on North American markets, lacks real-time data for active trading, charting is less robust than dedicated charting platforms.

Koyfin (Paid Tiers): Your Customizable Financial Dashboard

- Best For: Fundamental investors, RIAs (Registered Investment Advisors), those who need to consolidate institutional-quality data into personalized dashboards, macroeconomic analysis.

- Highlights: Koyfin's paid plans unlock its full potential, allowing users to build highly personalized dashboards with institutional-quality data. You gain unlimited watchlists, advanced charts, and real-time news feeds, all integrated onto a single screen. It excels at providing a comprehensive overview of financial markets, from individual stocks to macro indicators.

- Key Features:

- Unlimited watchlists with extensive customization for various asset classes.

- Real-time U.S. stock prices and extensive historical data.

- Advanced charting, screening, and financial analysis tools.

- Price alerts and news notifications.

- Consolidate fundamental, technical, and macroeconomic data points onto personalized dashboards.

- Pricing: Basic ($39/month), Plus ($79/month), Pro ($299/month). Annual discounts available.

- Pros: Institutional-grade data at a more accessible price, highly customizable dashboards, excellent for holistic market analysis, strong fundamental and macroeconomic focus.

- Cons: Free plan has significant limitations, can be complex to master, pricing can be high for casual investors.

Your Brokerage Apps: Convenience vs. Capability

- Best For: Existing customers who prioritize convenience, beginners who don't want another app, basic monitoring.

- Highlights: Most online brokers like Fidelity, Schwab, E-Trade, and Robinhood offer watchlist features directly within their trading platforms. This provides unparalleled convenience, as your watchlists are seamlessly integrated with your ability to trade.

- Key Features:

- Basic watchlists for stocks and sometimes other assets.

- Integration with your trading account.

- Usually includes real-time quotes and basic news.

- Pricing: Typically free with your brokerage account.

- Pros: Extremely convenient, all-in-one solution for watching and trading, no extra logins or subscriptions.

- Cons: Watchlist tools are often less powerful and less customizable than dedicated applications, charting is usually rudimentary, limited in advanced features like detailed SEC filing analysis or sophisticated alerts.

Choosing Your Co-Pilot: Aligning Your Watchlist App with Your Investing Strategy

The "best" watchlist app isn't a universal truth; it's the one that perfectly aligns with your investing goals, strategy, and preferred level of analytical depth. Here's a framework to help you decide:

- Define Your Investor Persona:

- The Beginner/Casual Investor: You're just starting, primarily interested in basic tracking, news, and price alerts. You don't need complex charts or deep fundamental dives yet.

- Recommendation: Start with Yahoo Finance or the free tier of TradingView or Koyfin. Your brokerage app is also a convenient starting point.

- The Active Trader/Day Trader: Speed, real-time news, lightning-fast alerts, and minimal latency are critical. You need to react quickly.

- Recommendation: Benzinga Pro is purpose-built for you. Paid tiers of TradingView also offer the speed for technical plays.

- The Technical Analyst: Charts are your language. You need a vast array of indicators, drawing tools, and the ability to set complex alerts based on price action.

- Recommendation: TradingView (paid tiers) is the undisputed champion here.

- The Fundamental/Value Investor: You dig deep into financial statements, company operations, and long-term prospects. SEC filings, historical data, and robust screening are key.

- Recommendation: Stock Rover offers unparalleled fundamental data. AssetRoom is a fantastic complement for understanding business activities, and Koyfin (paid tiers) provides institutional-grade data.

- The Dividend/Income Investor: You focus on stable companies with strong dividend histories and future projections.

- Recommendation: Stock Rover excels in dividend analysis and projections.

- The Multi-Asset Trader (Stocks, Crypto, Forex): You need a platform that can handle diverse asset classes seamlessly within the same watchlist.

- Recommendation: TradingView (free or paid) and Yahoo Finance are strong contenders.

- Evaluate Your Budget:

- Can you get by with a free option? Many powerful tools exist without a price tag.

- Are you willing to pay for advanced features, real-time data, or a more polished experience? Think of the subscription as an investment in better decision-making.

- Prioritize Key Features:

- What's non-negotiable for your strategy? If you're a news-driven trader, Benzinga Pro's real-time feed is paramount. If you're a long-term investor, AssetRoom's SEC filing summaries might be more valuable.

- Do you need advanced charting? Deep fundamental data? Real-time crypto prices? Make a list of your top 3-5 must-have features.

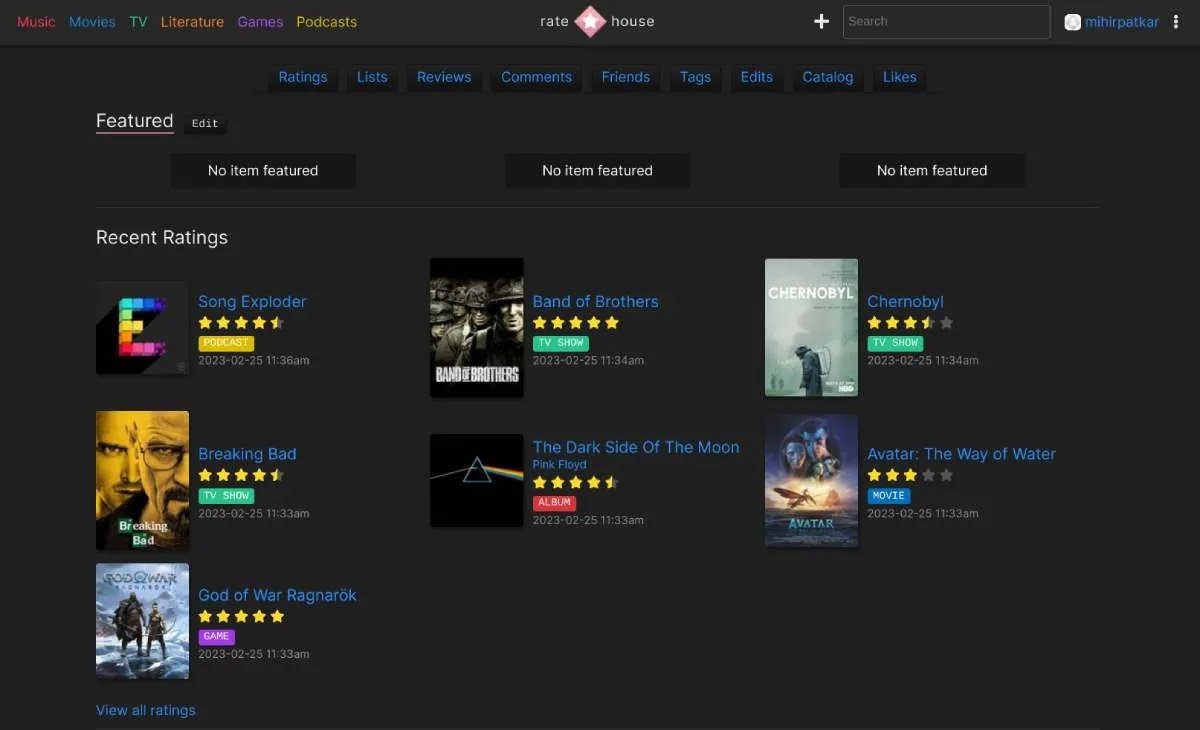

Curious to see what a well-structured watchlist looks like? You can explore my watchlist for ideas and inspiration, and to see how different types of assets can be tracked.

Beyond the App: Mastering Your Watchlist Habits

Choosing the right app is only half the battle. To truly leverage its power, you need to cultivate smart watchlist habits:

- Keep It Curated, Not Crowded: Resist the urge to add every interesting stock you hear about. A watchlist of 20-50 highly relevant assets is far more effective than 200 you rarely check. If a stock sits on your list for months without action or fresh research, question its place there.

- Organize with Purpose: Use multiple watchlists to segment your focus. One for "High Conviction Buys," another for "Industry Leaders," perhaps one for "Speculative Plays." This makes analysis targeted and prevents mental clutter.

- Set Smart Alerts (and Act on Them): Don't just set basic price alerts. Use advanced conditions available in your app (e.g., "price crosses 50-day moving average," "volume spikes 2x average," "new SEC filing"). More importantly, have a plan for how you'll react to these alerts.

- Regular Review and Pruning: Your watchlist isn't static. Dedicate time each week or month to review your lists. Has the investment thesis changed for a company? Has a stock become overvalued or undervalued? Remove irrelevant entries and add new potential opportunities.

- Integrate with Your Research Workflow: Your watchlist should be a launchpad, not an endpoint. When an alert fires or you see something interesting, use your app's integrated data, news, and charting tools to deepen your research. Think of it as the starting point for your due diligence.

Frequently Asked Watchlist Questions

Are free watchlist apps good enough for serious investors?

For many, yes! Free options like Yahoo Finance and AssetRoom offer robust features for monitoring. Even free tiers of TradingView and Koyfin provide excellent foundational tools. They are "good enough" if they meet your specific needs for data, alerts, and analysis. However, active traders or those requiring institutional-grade data, real-time speeds, or highly specialized analytics will likely benefit from paid platforms.

Can I track crypto on a stock watchlist app?

Absolutely. Many modern watchlist apps, including Yahoo Finance and all tiers of TradingView, offer comprehensive support for cryptocurrencies alongside traditional stocks, forex, and commodities. This allows you to manage a diverse portfolio from a single platform.

How many stocks should be on my watchlist?

There's no magic number, but quality over quantity is key. A manageable watchlist typically ranges from 10 to 50 assets. Any more and it becomes difficult to track each company effectively. The goal is to deeply monitor a select group, not superficially track hundreds. For organizational purposes, consider splitting a larger list into several smaller, thematic watchlists.

What's the difference between a watchlist and a portfolio tracker?

A watchlist is for monitoring potential investments or assets you're researching. It helps you keep an eye on market movements and company news before you commit capital or as part of ongoing research for existing holdings. A portfolio tracker, on the other hand, specifically tracks your actual investments. It calculates your gains/losses, portfolio allocation, and overall performance based on your buy/sell transactions. While some platforms combine both features, their core functions are distinct.

Your Next Step: Taking Control of Your Investment Focus

The world of investing rewards clarity, diligence, and informed decision-making. By thoughtfully Choosing Watchlist Apps & Platforms that resonate with your unique investing strategy, you're not just downloading software; you're equipping yourself with a powerful tool to navigate the markets with confidence.

Start by assessing your needs, experimenting with a few free options, and then, if necessary, consider a paid service that offers the precision and depth your strategy demands. Your financial future deserves a focused approach, and a well-utilized watchlist is your clearest path to achieving it.